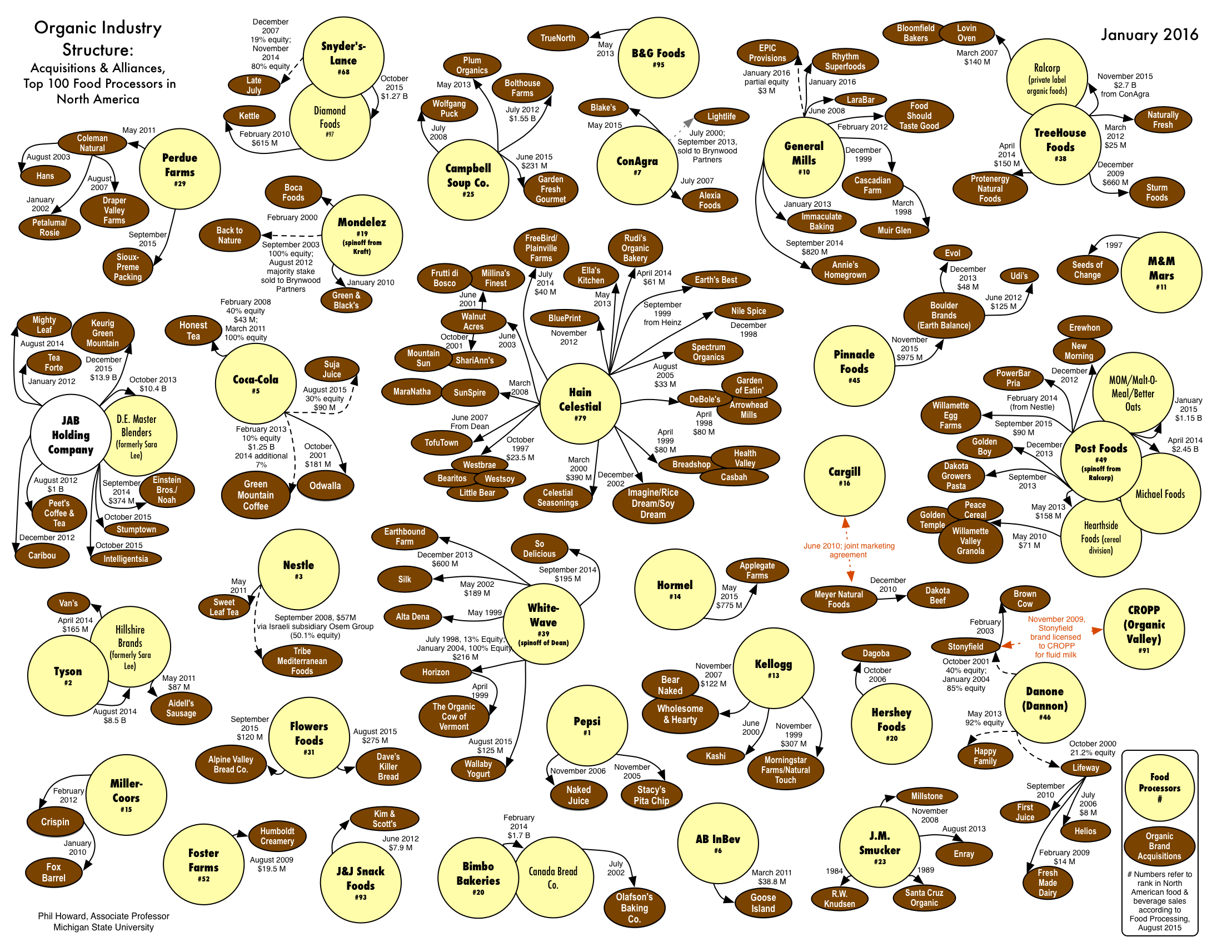

The development of the USDA National Organic Standard in place of differing state/regional standards was widely predicted to accelerate trends of increasing consolidation in this sector. The first draft of the standard was released in 1997; what changes in ownership and control have since occurred?

The development of the USDA National Organic Standard in place of differing state/regional standards was widely predicted to accelerate trends of increasing consolidation in this sector. The first draft of the standard was released in 1997; what changes in ownership and control have since occurred?

click for larger version of graphic above

click for larger version of graphic above

PDF version of Organic Industry Structure: Acquisitions & Alliances, Top 100 Food Processors in North America

The first wave of acquisitions of organic processors was concentrated between December, 1997 when the draft USDA standard was released, and its full implementation in October, 2002. A second wave of acquisitions has been occurring since 2012. Few companies identify these ownership ties on product labels.1

Updates:

- October 2019: Hometown Foods (Pillsbury) acquired Arrowhead Mills and SunSpire from Hain Celestial for $15M

- June 2019: Mondelez acquired majority stake in Perfect Snacks

- May 2019: Perdue acquired Panorama Meats, Post proposed to acquire cereal business of TreeHouse Foods for $110M (called off January 2020 after objections by FTC)

- April 2019: Danone divested Earthbound Farm (sold to Taylor Farms); Campbell Soup Co. divested Bolthouse Farms (sold to Butterfly Equity for $510M)

- December 2018: Nestle-Osem divested Tribe (sold to Lakeview Farms)

- November 2018: Kraft Heinz acquired Primal Kitchen for $200M

- September 2018: Kraft Heinz acquired Ethical Bean Coffee; Keurig Dr Pepper acquired Core Nutrition for $525M

- July 2018: Dean Foods increased stake in Good Karma to majority share

- June 2018: Tyson acquired Tecumseh Poultry/Smart Chicken; ConAgra acquired Pinnacle Foods (Earth Balance/Udi’s/Evol) for $10.9B

- May 2018: Pepsi acquired Bare Foods

- February 2018: Danone’s venture division invested in Harmless Harvest coconut water; Nestlé acquires majority stake in Terrafertil/Nature’s Heart

- December 2017: Campbell Soup Co. acquired Snyder’s-Lance for $4.87B

- November 2017: Unilever acquired Tazo Tea (from Starbucks) for $384M; Nestle acquired Chameleon Cold-Brew; Mars acquired minority stake in KIND Snacks

- September 2017: Nestlé acquired Sweet Earth and a 68% stake in Blue Bottle Coffee; B&G acquired Back to Nature (from Brynwood Partners and Mondelēz) for $162.5M; Unilever acquired Pukka Herbs

- July 2017: Lactalis announced it would acquire Stonyfield from Danone for $875 M; Campbell Soup Co. acquired Pacific Foods for $700 M; AB InBev acquired Hiball

- June 2017: Dean Foods acquired Uncle Matt’s Organic

- May 2017: Dean Foods acquired minority stake in Good Karma

- April 2017: Unilever acquired Sir Kensington’s

- February 2017: Maple Leaf Foods (#43) acquired Lightlife Foods from Brynwood Partners

- December 2016: B&G Foods (#95) acquired Victoria Fine Foods

- November 2016: Pilgrim’s Pride (#18, but 76% owned by #4 JBS) acquired The GNP Company (Just BARE chicken) for $350 M; Dean Foods and Organic Valley form a 50/50 joint venture; Pepsi acquired KeVita; Dr. Pepper Snapple Group acquired Bai for $1.7 B

- July 2016: Danone announced it would acquire WhiteWave for $12.5 B. Deal completed with the condition that Stonyfield be sold in April 2017

- June 2016: Coca-Cola acquired minority stake in Aloe Gloe; Kellogg acquired Pure Organic

- May 2016: Hormel acquired Justin’s (nut butters) for $286 M

- March 2016: Pulmuone acquired Vitasoy/Nasoya for $50 M

- General Mills investments via its “301 Inc.” venture capital arm include the following: $1.25 M in Tio Gazpacho in March 2016, $2.1 M in Good Culture in March 2016 (+$3 M in September 2016), $18M in Kite Hill in May 2016, additional $6 M in Rhythm Superfoods in January 2017, $6.5 M in Farmhouse Culture in March 2017, $3 M in Purely Elizabeth in April 2017, $12 M in GoodBelly parent NextFoods in June 2018

Other transactions:

- Swander Pace acquired Bragg Live Food Products in June 2019

- NextWorld Evergreen acquired Alter Eco in December 2017

- Lavazza acquired 80% of Kicking Horse Coffee for $160 M in May 2017

- Verde Farms acquired Estancia Beef in May 2017

- Andersons, Inc. acquired Purity Foods (Vita-Spelt, Nature’s Legacy) in April 2017

- Cal-Maine announced it would acquire Dixie Egg Company in August 2016

- Fyffe’s (Ireland) acquired Highline Produce (Canada) for $111 M in May 2016

- Emmi (Switzerland) acquired Cowgirl Creamery in May 2016 and Redwood Hill Farm & Creamery in December 2015

- John B. Sanfilippo & Son, which was ranked the 98th largest food processor in 2012, acquired Orchard Valley Harvest (May 2010, $29.5 M)

- Heinz acquired a 19.5% stake in Hain Celestial in 1999 while also transferring ownership of their Earth’s Best brand, but sold all of its Hain Celestial stock in 2005

- ConAgra acquired Ralcorp in November 2012 for $6.8 B, but sold it to TreeHouse Foods in November 2015 for $2.7 B

PDF version of Organic Industry Structure: Major Independents and Their Subsidiary Brands

Most remaining independent organic processors have resisted substantial buyout offers (typically 2 times annual sales).2

Updates:

- Yogi Tea, which remains independent, acquired Choice Organic Teas

- Pacific Foods is no longer independent, acquired by Campbell Soup Co. for $700 M in July 2017

- Applegate Farms is no longer independent, acquired by Hormel in May 2015 for $775 M (following an investment from Swander Pace Capital in 2009)

- So Delicious/Turtle Mountain/Purely Decadent is no longer independent, acquired by WhiteWave in September 2014 for $195 M.

- Nature’s Path, which remains independent, acquired Que Pasa in November 2012, Country Choice Organic in July 2015, and 51% of Gorilly Goods in September 2016.

Network Animation of Data from 1995 to 2007

Produced in collaboration with Skye Bender-deMoll, an author of SoNIA – Social Network Image Animator.

PDF version of Organic Industry Structure: Private Label Brands

An increasing number of supermarkets, wholesale clubs and distributors are introducing organic private label products, in addition to chains that specialize in organic and natural foods.

See also: Organic Distribution & Retail Structure, Organic Farm Concentration

Literature Cited

1. Howard, Philip H. 2009. Consolidation in the North American Organic Food Processing Sector, 1997 to 2007. International Journal of Sociology of Agriculture and Food 16(1), 13-30. [PDF]

2. Howard, Philip H. 2009. Organic Industry Structure. Media-N: Journal of the New Media Caucus, 5(3). [online]

Don’t see Crofter’s Organic listed under Major Independents. In the jam category this is unique.

LikeLike

Crofter’s was nearly acquired by Clearly Canadian in 2008, but it didn’t go through:

http://www.foodbusinessnews.net/news/news-home/business-news/2008/09/clearly-canadian-backs-away-from-acquisitions.aspx

Also, I have focused on the largest independent organic processors, typically well over $10 million annually in sales.

LikeLike

Is there information on consolidation of organic cotton companies? or remaining independent?

LikeLike

Sorry, I haven’t looked into that, and don’t know if anyone else has. -Phil

LikeLike

Thank you Philip!

Just now discovering your contributions via the presentations at the Cornucopia Institute. Much appreciate your dedication to revealing the impact of corporate food power on community sustainable.

Is the thought of a possible documentary of interest to you?

LikeLike

Thank you for this work. It really helps when presenting information to consumers here in Western Australia.

Yours sincerely

Annie Dunn – Dunn & Walton

LikeLike