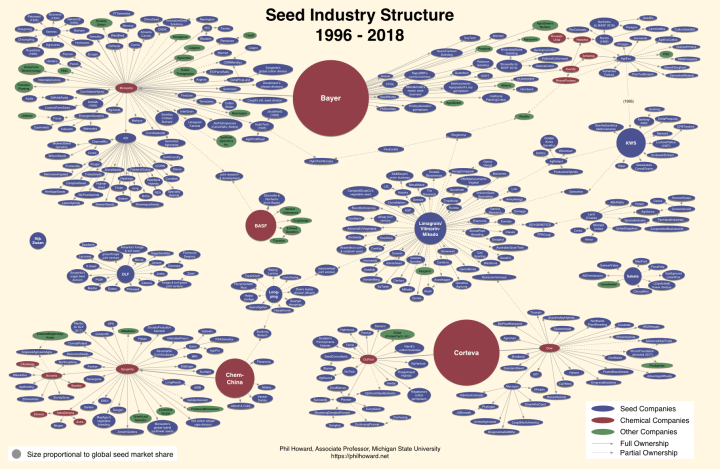

Recent years have seen the “Big 6” agrochemical/seed firms combine into a Big 4:

- Dow and DuPont merged in a deal valued at $130 billion (announced in 2015), and then divided into three companies, including an agriculture-focused firm called Corteva

- Chemchina acquired Syngenta for $43 billion (announced in 2016)

- Bayer acquired Monsanto for $63 billion (announced in 2016)

- Bayer’s seed divisions (including the Stoneville, Nunhems, FiberMax, Credenz and InVigor brands) were sold to BASF for $7 billion to satisfy antitrust regulators (2018)

These four firms are now estimated to control over 60% of global proprietary seed sales. A number of the brands acquired in previous acquisitions have been retired.

Changes in the last five years also include dozens of acquisitions and joint ventures involving other top global seed firms, such as Limagrain’s Vilmorin-Mikado subsidiary (France), DLF (Denmark) and Longping High-Tech (China).

China now has two seed firms ranked in the top ten in global seed sales, ChemChina and Longping High-Tech. Since 2017, Longping High-Tech has acquired Dow’s maize division in Brazil, and controlling stakes in seven seed firms based in China. The firm is reportedly planning additional acquisitions in Argentina. After acquiring the Switzerland-headquartered firm Syngenta, ChemChina is planning more acquisitions in China.

The graphic below shows ownership changes occurring from 1996 to 2018. Note that the size of the largest circles are proportional to global seed sales, which are dominated by Bayer and Corteva.

Click for PDF version of Seed Industry Structure, 1996 to 2018

Click for PDF version of Seed Industry Structure, 1996 to 2018

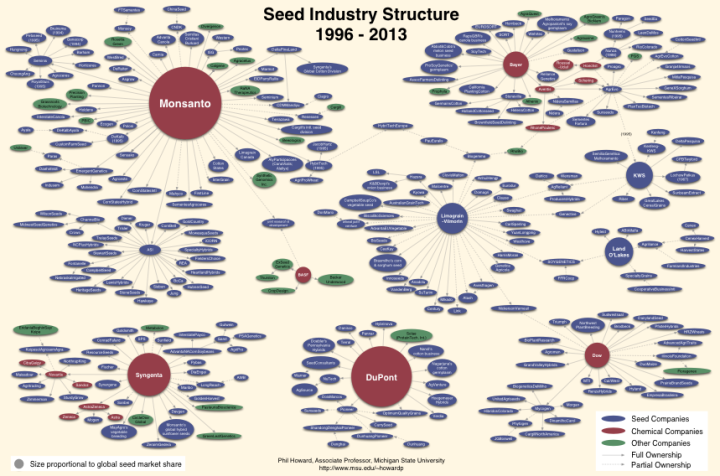

Below are earlier versions from (1) 1996 to 2013, and (2) 1996 to 2008 for comparison.

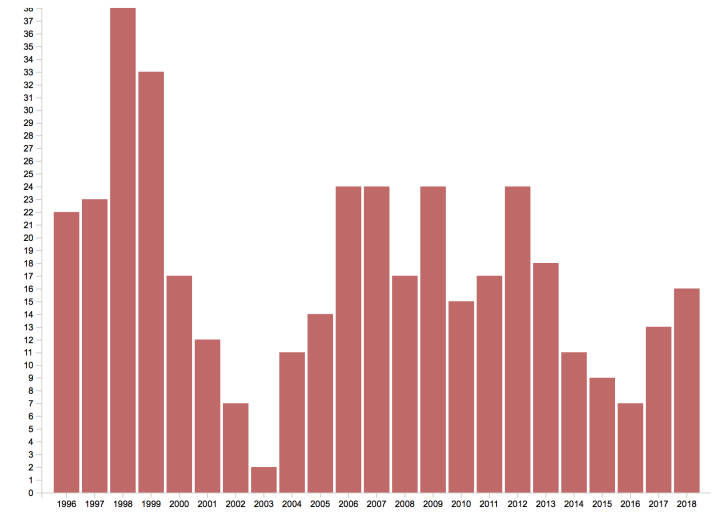

There were nearly 400 ownership changes involving these firms in the last 23 years. The chart below shows that the peak occurred in 1998, shortly after patented, genetically engineered seeds were commercialized.

Number of seed industry ownership changes by year, 1996 to 2018

Number of seed industry ownership changes by year, 1996 to 2018

For more details see:

- Howard, Philip H. How Corporations Control our Seeds. Pp. 15-29 in Bite Back: People Taking on Corporate Food and Winning (Saru Jarayaman & Kathryn De Master, eds.). Oakland, CA: University of California Press.

- IPES-Food. 2017. Too Big to Feed: Exploring the Impacts of Mega-Mergers, Consolidation and Concentration of Power in the Agri-Food Sector.

- Howard, Philip H. 2016. Concentration and Power in the Food System: Who Controls What We Eat? London: Bloomsbury Academic.

- Howard, Philip H. 2015. Intellectual Property and Consolidation in the Seed Industry. Crop Science, 55(6), 2489-2495.

- Howard, Philip H. 2009. Visualizing Consolidation in the Global Seed Industry: 1996–2008. Sustainability, 1(4), 1266-1287.

29 thoughts on “Global Seed Industry Changes Since 2013”